Study Reveals Working-Capital Concerns for Manufacturers

In today’s economy, companies up and down the metals and machining supply chains are enduring uneven growth and significant cash flow constraints. Demand is up, with domestic new orders for machine tools and related equipment and technology rising 15.3% in June (to $459.39 million) and 7.3% (to $506.97 million) in July.

Nevertheless some companies, particularly smaller firms, are struggling. While sales among large manufacturing firms started to recover in the second quarter of 2009, small firm sales remain sluggish, according to data published by the New York Federal Reserve. This makes smaller companies even more susceptible to working-capital challenges like slow-paying customers or extended payment terms, as they already have less power to negotiate with their customers and less cash on hand to cope with fluctuations in business.

Since the start of the recession over three years ago, U.S. bank lending has declined precipitously, with commercial and industrial loans falling approximately 20 percent from March 2008 to June 2010. Amid this climate of cash-flow constraint and market turbulence, many companies seeking financing from traditional sources (e.g., banks, asset-based lenders and factors) are finding those options closed to them or prohibitively expensive. Consequently, the time is ripe for alternative sources of capital and some businesses in the manufacturing sector are taking advantage of the opportunity.

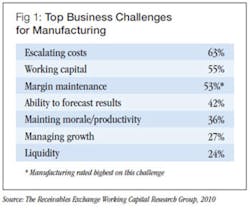

To understand the range of working capital challenges in the manufacturing as a whole, The Receivables Exchange, an online marketplace for working capital, recently conducted a study — “Working Without a (Working Capital) Net: Cash Flow Constraints in the Manufacturing Industry.” It offers insight into how U.S. manufacturers are coping with obstacles and controlling cash flow in this credit climate. Companies in this sector cite escalating costs, working capital, margin maintenance, and slow-paying customers as their chief concerns (see Fig. 1). The study also revealed a growing market for alternative sources of capital.

On the subject of working capital, various important case findings were derived.

Extended payment terms reduce cash on hand

One challenge facing manufacturers is the steady increase of “days sales outstanding” (DSO) as customers continue to extend payment terms to 60 days and beyond. Manufacturers have the highest incidence of customers extending payment terms of any industry examined in our study; 42 percent of surveyed companies cited DSO as a significant source of working capital issues.

“Everyone wants to hold onto cash longer, and get paid quicker,” stated Ken Koenemann, managing director, TBM Lean Value Chain Practice, in a recent article in Industry Week. When customers extend their payment terms, business owners and decision-makers may find it difficult to negotiate with their customers, especially larger customers. This was the case with Stainless Steel Products Inc., a Long Island-based manufacturer and wholesaler of metal wire.

“A few years ago, some of our key customers indicated that they were going to extend payment terms to 60 days,” explained Ralph Rosenbaum, the company’s owner, president and CEO. “We didn’t want to lose their business, so we agreed to the terms. We had no choice.”

When DSO is stretched, small and mid-sized companies like Stainless Steel Products find themselves in a “working capital squeeze.” They have to pay for inventory and supplies upfront, but it takes longer and longer for that upfront investment to generate cash through sales. When this happens, manufacturers whose cash conversion cycle (see Fig. 2) had been relatively predictable frequently are caught unprepared. Until manufacturers find ways to shorten DSO, this issue is likely to persist.

Credit is insufficient, or non-existent

Our study also revealed that manufacturing companies are concerned about the escalating cost of doing business, with 63 percent of respondents citing this as their greatest challenge. And there is a good reason for this: the cost of raw materials, equipment, shipping, fees, and taxes is indeed rising for many companies. While larger firms in the supply chain have some power to negotiate discounts, smaller firms are unable to do so.

Unfortunately, as costs rise and customers extend payment terms, credit is growing more scarce, and traditional financing more restrictive than ever. After the financial crisis, like many companies of its size, Stainless Steel Products found that getting new credit was more difficult than ever. The credit that was available came with more restrictive terms and less flexibility. Ralph Rosenbaum was dismayed because the fundamental health of his company remained the same.

“Before that time, credit was readily available,” Rosenbaum said. “You could get credit very easily. Then almost overnight it became extremely difficult, and that was surprising. Suddenly our financing wasn’t enough to keep up with operations and growth.”

They are hardly alone. Fewer than half the companies we surveyedindicated that their lines of credit were sufficient to cover their working capital needs; one in threestated that they needed a financing option in addition to their line of credit.

A lack of financing can have a number of negative consequences for manufacturers, especially when it comes to improvements to facilities, tooling, equipment, production or assembly lines. Even though they produce long-term savings, such improvements tend to be highly capital-intensive. According to a report by the International Trade Administration focusing on machine tool manufacturing, “most lending institutions [are] reluctant to offer the capital necessary to reorganize operations or to improve efficiencies.” Without these upgrades, manufacturers are unable to streamline processes and reduce costs.

Demand for alternative financing

Catamount Glassware is a Vermont producer of glass products, and the only U.S. manufacturer of certified heat-resistant glassware. It produces customized bottles for popular breweries like Magic Hat and Otter Creek. About ten years ago, when Catamount president Alain Karyo, decided to recapitalize the business through a long-term SBA loan, he was put off by the restrictive terms presented to him by the lender.

“They wanted to take absolutely everything as collateral, leaving us with zero flexibility,” Karyo said. “We probably could have grown at a more rapid rate, but I was never willing to take on the level of risk and the additional workload associated with disclosure to the lenders.”

As a result of his experience with bank loans, Karyo has relied primarily on alternative financing to fund his company. He’s among a number of business owners and executives who are supplementing or replacing their traditional financing with innovative financial solutions.

In our study, nearly half of manufacturing companies said they would be willing to try forms of financing they’d never used before. Alternatives that are commonly considered include widespread use of credit card float (e.g., for T&E or other business expenses); directly incentifying earlier payment using techniques like invoice discounting; taking advantage of Supply Chain Finance opportunities offered by large customers; and the sale or auction of receivables to a third party.

A receivables financing option

The last of these has been the alternative of choice for both Karyo and Rosenbaum. Specifically, they use The Receivables Exchange, an online marketplace for working capital that lets businesses turn their receivables into cash by selling them in an online auction. The process usually involves a one-day turn at approximately a one-percent rate. It offers benefits such as increased flexibility and lower cost, and is becoming a best practice for CFOs and owners at manufacturing companies large and small.

The main innovation of The Receivables Exchange is this: rather than handing over your receivables to a factor and agreeing to a single (usually high) rate, you can sell them in a real-time auction. Buyers (who are institutional investors such as banks, asset-based lenders, family offices and factors) compete to purchase a manufacturer’s invoices, driving down the cost of capital. The manufacturer selects which receivables to sell, and buyers bid according to the quality of the receivables and the terms set by the offering company.

Karyo has been using The Receivables Exchange since 2009, and is “amazed” at how easy-to-use and affordable it is. “By selling the receivables of my best customers, it was a very cost-effective way to increase our liquidity,” he said.

For Rosenbaum, the most attractive feature of the Exchange is the flexibility. He sets the maximum discount fee he is willing to pay, the minimum advance amount he will accept, and the duration of his auction. He doesn’t have to accept any bid outside of these parameters. There are no personal guarantees, long-term contracts, or all-asset liens. It’s a major improvement over traditional financing, including factoring.

“We briefly looked into factoring, but The Receivables Exchange added so much flexibility,” Rosenbaum said. “We can choose which receivables to sell and when. We set the terms of each auction. We don’t have to be beholden to a factor or a bank. It gives us one less thing to worry about.”

Weighing the benefits

Using online receivables financing to access working capital, both Catamount and Stainless Steel Products have been able to overcome many of the challenges uncovered in the study. Instead of panicking when their customers extended payment terms, they’re able to shorten DSO to as little as one day, turning sales into cash almost immediately. With more cash on hand, they can buy more materials, fulfill more orders, and take on new customers. More cash flow also allows Catamount to take advantage of discounts from suppliers, who are aggressively competing for his business. (See Fig. 3.)

“We have been able to take advantage of some very significant raw material discounts as a result of having this new-found flexibility in our working capital management,” Karyo said. The Receivables Exchange also helped Stainless Steel Products fulfill a particularly large order from an existing customer. The material required for the order was available from a new vendor that had no prior relationship with the company. Rosenbaum was able to negotiate credit with the vendor by promising to pay within 15 days, and the Exchange helped him get the capital he needed to make good on the agreement.

Another advantage of The Receivables Exchange is that it can help manufacturers to build a “cash cushion,” to weather seasonality or business disruptions. These issues are top of mind for manufacturers, given the tightly woven supply chain and the increased vulnerability of small suppliers. As finance expert Mike McDonald wrote recently for Manufacturing.net, “If you’re a manufacturing company and your key supplier goes out of business, it becomes a red-alarm fire.”

The Receivables Exchange lets businesses build cash reserves for any disruptive event, and take a more active approach to working capital management overall.

As the global economy continues its fitful recovery, ensuring sufficient access to capital at a reasonable cost will remain a significant challenge for manufacturing companies. Weathering these challenges is vital, not only to short-term profitability, but to the financial health and long-term stability of small and mid-sized manufacturers.

There are financial alternatives out there. Smart companies have more opportunities than ever to create competitive advantage using an optimal working-capital structure. Online receivables financing can help manufacturers break free of the constraints of traditional financing, with flexibility, affordability and speed. It pays to do your research.

Nic Perkin is co-founder and president of The Receivables Exchange, an online marketplace for sale and purchase of accounts receivable. The Receivables Exchange allows businesses to access working capital flexibly and affordably, without the constraints of traditional financing.