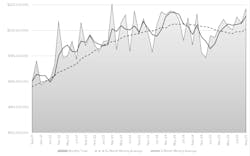

Machine shops and other U.S. manufacturing operations’ orders of cutting tools increased in value to $222 million during September, a 5.3% rise from August 2025 and a 14.7% improvement versus September 2024. Through nine months of purchasing activity, 2025 cutting tool orders have totaled $1.88 billion, a decrease of -1.1% compared to January-September 2024.

These results are drawn from the latest Cutting Tool Market Report, presented by AMT - the Assn. for Manufacturing Technologies and the U.S. Cutting Tools Institute.

“For September, cutting tool deliveries were normal, and some optimism that unstable business conditions may be improving was tempered by the higher cost of products and lower profitability,” according to Jack Burley, chairman of AMT’s Cutting Tool Product Group and president of Big Daishowa, a cutting tool manufacturer. “Unit prices for most cutting tools are up by double digits due to price hikes caused by tariffs and increased costs for raw materials. I don’t expect to see any improvements in the fourth quarter.”

The monthly CTMR tracks orders of cutting tools as an index to overall manufacturing activity, as those products are critical consumable products across major industries like automotive, aerospace, construction, defense, energy, and numerous other sectors.

Machine shops and other operations order cutting tools according to their current and anticipated manufacturing requirements.

“Most users remain concerned about their backlog, future orders, and inventory, especially for the transportation sectors of manufacturing,” Burley said.

The uncertainty Burley described has been apparent for several months, comprised of general concern over persistently tepid industrial demand and, since the second quarter of this year, the accumulating effect of U.S. tariffs.

But an analyst quoted by AMT offered a more positive view based on the current data.

“Cutting tool orders for September came in 14.7% above September 2024,” offered ITR Economics’ senior economist Michelle Kocses. “Even more encouraging is that the third quarter, as a whole, surpassed the third quarter of 2024, suggesting that this budding positive momentum is not a one-month fluke.”

Kocses continued: “Buttressing this rise, U.S. industrial production is in an accelerating growth trend. CapEx is beginning to pick up as confidence gradually improves, but there are soft spots in oil-and-gas drilling and heavy-truck markets. Forward-looking evidence points to measured optimism for 2026.”