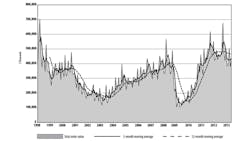

U.S. manufacturers’ new orders for machine tools and related technology increased 13.6% to $430.06 million during May, from a revised total of $378.56 million during in April. It was a solid rebound from a marked decline in the previous monthly However, the new figure represents a -7.6% decline versus the May 2012 result, $465.38 million.

“A rise in U.S. manufacturing technology orders is welcome as we move into the summer months, which are typically soft,” stated Patrick W. McGibbon, AMT vice president - Industry Intelligence.

AMT – The Association for Manufacturing Technology collects actual data on new orders for machining equipment from companies participating in its U.S. Manufacturing Technology Orders monthly report. Both domestically produced and imported products are included in the total.

The preliminary totals indicate a significantly higher volume of orders for metal cutting equipment during May -- $376.31 million – than for metal forming and fabricating equipment -- $53.76 million – a typical result; but, the rate of increase for former category was significantly lower than for the latter from April to May, 11.0% compared to 35.4%.

“New technologies are creating change in automotive production, while many aerospace manufacturers are making shifts within their supply chains,” McGibbon continued. Contract machining is also seeing growth thanks to the cost advantages of manufacturing within the U.S. Meanwhile, foreign direct investment within the U.S. continues to increase, and all of these factors are contributing to new capital investment within manufacturing.”

The May result brings the year-to-date total for manufacturing technology orders to $2,085.14 million, a decline of -6.9% versus the total for January-May 2012, $2,239.92 million.

Southern and Central Demand Surges

The USMTO report includes data results from six manufacturing regions as well as the nationwide figures.

In the Northeast, manufacturing technology orders fell -1.0% during May to $71.56 million from $72.25 million recorded during April. The latest figure up 5.1%, year-on-year, from $465.38 million posted for May 2012.

The region’s year-to-date total machine tool orders are $322.59 million, down -2.1% versus the five-month total for 2012.

The Southeast region had manufacturing technology orders of $43.57 million in May, up 23.7% from April’s $35.23 million total. The new figure is up slightly (0.7%) from the May 2012 result, $43.27 million.

The Southeast’s year-to-date total for manufacturing technology orders is $183.51 million, 12.4% less than $209.39 million posted for the first five months of 2012.

The North Central-East region’s May manufacturing technology orders rose 36.0% in May, up to $100.46 million from $73.89 million recorded during April. Compared to the $537.92 million recorded during May 2012, the new figure was off by -29.5%.

The region’s year-to-date total for new orders is $537.92 million, -8.8% compared to $590.12 million recorded during January-May 2012.

The North Central-West region’s manufacturing technology orders slipped -0.2% during May, down to $73.46 million from $73.61 million during April. The new result also is down -16.1% compared to $87.54 million posted for May 2012.

the region’s January-May 2013 new orders total $407.25 million, down -0.5% compared with $409.18 million for the comparable period of 2012.

In the South Central region, May 2013 manufacturing technology orders rose 9.9% to $65.29 million, from $59.42 million during April, and up 6.5% compared with the May 2012 figure.

The first five months of 2013 have seen new orders fall -23.8% to $320.22 million, compared to $420.40 million for January-May 2012.

Last, in the West, the May result is $75.72 million, 18.0% higher than April’s $64.17 million, and up 20.6% compared with $62.78 recorded for May 2012. The year-to-date total for the West region is $313.65 million, 11.6% above the five-month total for the same period of 2012.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.