Steel Output, Capacity Utilization Slowing Worldwide

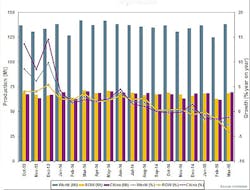

Global raw steel production for the 65 countries reporting to the World Steel Association was 138 million metric tons in March 2015, a -2.7% decrease compared to March 2014. With a bit more than 400 million metric tons of steel produced worldwide during the first three months of this year, the year-to-date total of raw steel production is down 1.8% versus the first-quarter total for 2014..

The slowing production rate matches the conclusions of World Steel Assn.’s recent short-range outlook for steel consumption, which forecasts an increase of just 0.5% this year over 2014, thanks to factors that include recession in China, falling oil prices, and uneven industrial recovery in the EU.

The new figures are drawn from the World Steel Association’s monthly report on global raw steel output. The Brussels-based trade group represents steelmakers in 65 countries, and each month it releases a report on global raw (or crude) steel output and capacity utilization. The report references carbon steel produced by basic oxygen furnaces and electric arc furnaces, prior to metallurgical refining and casting into semi-finished products, such as slabs, blooms, or billets. Stainless steels and other specialty alloy steels are not included.

March 2015 raw steel capacity utilization slipped to 71.6%, 1.8% lower than February 2015, and 4.0% lower than March 2014.

China, as usual, led all nations in raw steel production volume during March, with 69.5 million metric tons, 12.2% more than the February total but 1.2% less than the March 2014 volume. Chinese steelmakers have produced 200.1 million metric tons during the first three months of this year, 1.7% less than during January-March 2014.

Japan, the world’s second-largest steelmaking nation, produced 9.3 million metric tons during March, up 10.0% from the February total but down 4.5% from the March 2014 result. For the year-to-date, Japanese steelmakers have produced 26.7 million metric tons of raw steel, 3.0% less than their 2014 pace.

The Asian region produced 272.0 million metric tons of raw steel during the first quarter, a decrease of 1.1% over the Q1 2014 total.

By contrast, first-quarter raw steel production in the European Union (28 countries) was 43.7 million metric tons, down 0.6% compared to Q1 2014.

Among the individual nations, Germany reported March raw steel production of 3.87 million metric tons, up 10.2% from February but down 4.4% from March 2014. For the first three months of the year, German producers’ raw steel production was 11.1 million metric tons, or 2.0% less than during Q1 2014.

Italian steelmakers produced 2.1 million metric tons during March, 6.45% more than during February but 9.8% less than the March 2014 result. For the year-to-date, Italy’s raw steel production total is 5.9 million metric tons, 10.2% less than during the January-March 2014 period.

The C.I.S. region (Russia and its satellites) produced 24.8 million metric tons of raw steel during the first quarter of 2015, 5.9% less than during the same months of 2014. Russia’s steelmakers’ March 2015 production was 5.98 million metric tons, up 3.69% from February and up 0.2% from March 2014. The three-month total for Russia was 17.97 million metric tons, or 4.5% more than during the comparable three-month period of 2014.

Another of the world’s largest steel-producing nations, Ukraine, produced 1.69 million metric tons during March, or 6.87% more than during February. However, the March total is 35.6% less than the March 2014 total.

North American raw steel production for January-March 2015 was 28.1 million metric tons, or 6.4% less than during first quarter of 2014. U.S. steelmakers’ March tonnage rose 5.9% from February to 6.55 million metric tons. That raised the U.S. steel industry’s first-quarter total to 19.96 million metric tons, or 7.6% less than the Q1 2014.

Finally, in Brazil steelmakers’ raw steel output during March totaled 2.8 million, up 3.8% from the February total but down 7.44% from March 2014. Brazil’s 2015 year-to-date total is 8.42 million metric tons, or 0.7% more than they produced during the January-March 2014 period.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.

Matt LaWell

Staff Writer

Staff writer Matt LaWell explores news in manufacturing technology, covering the trends and developments in automation, robotics, digital tools and emerging technologies. He also reports on the best practices of the most successful high tech companies, including computer, electronics, and industrial machinery and equipment manufacturers.

Matt joined IndustryWeek in 2015 after six years at newspapers and magazines in West Virginia, North Carolina and Ohio, a season on the road with his wife writing about America and minor league baseball, and three years running a small business. He received his bachelor's degree in magazine journalism from Ohio University.