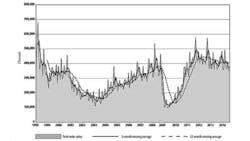

U.S. machine shops and other manufacturers ordered $356.69 million worth of new machine tools and related technology during August, less than 1% more than during July ($355.18 million) and 6.0% less than during August 2013. The figures are drawn from the latest U.S. Manufacturing Technology Orders report, a monthly summary of actual data prepared by AMT – The Association for Manufacturing Technology.

USMTO figures are actual data reported by participating manufacturers and distributors, and cover demand for metal-cutting equipment and metal forming and fabricating equipment, both domestically sourced and imported products, with the combined figure representing the monthly total.

The August data brings the 2014 total for new orders to $3.077 billion, down 2.4% versus the eight-month total for 2013.

“U.S. manufacturing activity remains at a brisk pace, and especially encouraging for manufacturing technology orders was a recent uptick in durable goods orders, particularly in aerospace, automotive, and several other key industries,” observed AMT president Douglas K. Woods.

“There has also been good news in factory employment, as more manufacturers add workers to their payrolls,” Woods continued. “With AMT’s Global Forecasting & Marketing Conference taking place this week in Detroit, featuring some of the top industry analysts and economists, we believe we will be hearing more positive news from their forecasts for the manufacturing technology industry over the next few years.”

The August regional data available in the USMTO suggests some strength in the Southeast, though the results are incomplete. AMT’s reporting accounts for changes in the survey participants from year to year, meaning that comparisons for Metal Forming and Fabricating equipment orders are not an accurate reflection of the current data. AMT explained that data is adjusted to reflect this change, but some categories remain unreported.

In the Northeast region, the USMTO shows August metal-cutting equipment orders of $60.40 million, up 14.1% from July and down 3.7% from August 2013. The region’s year-to-date results are down 6.8%.

The Southeast delivered new metal-cutting equipment orders totaling $287.94 million, up 41.8% over July’s total and up 20.6% over the August 2013 results. The eight-month order total for the Southeast is 1.9% higher than the same figure for the January-August 2013 period.

The North Central-East is the only region among six with a full complement of order data. August manufacturing technology orders declined 4.2% from July, to $87.42 million; and down 11.5% compared with the August 2013 result.

The North Central-East region’s 2014 year-to-date total of $844.02 million is 4.0% more than the eight-month total for 2013.

In the North Central-West region, metal-cutting equipment orders rose 6.3% from July, to $60.98 million for August, but down 2.3% versus the August 2013 results.

The year-to-date total for the North Central-West region’s manufacturing technology orders is $507.68 million, off the 2013 pace by 12.9%.

In the South Central region, metal-cutting equipment orders fell 27.5% from July, and 14.4% from August 2014. The eight-month result for all manufacturing technology orders in the region is $482.12 million, which is down 1.2% versus the same period of 2013.

Finally, in the West region, metal-cutting equipment orders fell 1.1% from July and 9.0% from August 2013. For the year-to-date, the region’s metal-cutting equipment orders are up 1.3% compared with January-August 2012.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.