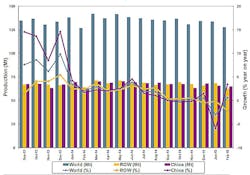

Raw steel production declined to 127.6 million metric tons worldwide during February, a slide of nearly 5% from January to February, according to the World Steel Association’s monthly tally. It is the second-consecutive monthly decline in the critical industrial segment, and the third decline the past four months. The slowing output apparently matches the Association’s recent mid-range forecast, which last October anticipated that global steel consumption would rise at just 2.0% for 2014 and 2015, a slower rate than in recent years.

Among the largest steelmaking nations, the February declines were particularly sharp in the U.S. and South Korea, while China’s steel industry posted a decline of less than 1%, a result that is more in line with the shorter month.

The February 2015-to-February 2014 comparison was more encouraging, with a 0.6% increase over the February 2014 tonnage.

Global steel capacity utilization in February 2015 rose 3.8 percentage points from January, to 73.4%. That figure is -1.7 percentage points lower than February 2014, World Steel noted.

The association’s monthly report tracks raw (or crude) steel tonnage and capacity utilization across 65 countries. It notes that its participating countries represent about 98% of the world’s raw steel output.

Raw steel is the product of basic oxygen furnaces and electric arc furnaces, prior to metallurgical refining and casting into semi-finished products, such as slabs, blooms, or billets. World Steel’s results include data for carbon and carbon alloy steel output. Stainless steels and other specialty alloy steels are not included.

China remains the world’s highest-volume steel producer, with a February output estimated at 65.0 million metric tons, down 0.7% from January but up 3.4% from the February 2014 output. China’s total production for the first two months of 2015 is reported as 130.5 million metric tons, down 1.5% from the year-to-date volume for 2014.

Steel production in other Asian countries showed less stability. In Japan, the world’s second-largest steelmaking nation, February output declined 6.5% to 8.4 million metric tons. That result was 0.2% less than the February 2014 volume, and brought Japan’s year-to-date total to 17.4 million metric tons, down 2.2% from the comparable figure for 2014.

South Korean steelmakers produced 5.1 million metric tons during February, 13.8% less than during January and 4.4% less than during February 2014. The January-February total for the country stands at 11.01 million metric tons, which is 3.6% off the pace set during the same period of 2014.

India’s February steel output fell 9.7% to an estimated 6.9 million metric tons, though that would represent a 5.6% rise over the year-ago total. For the first two months of the year, India has reported steel tonnage of 14.6 million metric tons, a 7.2% improvement over the 2014 figure.

European Union steel production declined 4.6% in aggregate during February, and the largest producing nation in the region – Germany – saw steel output decline 4.5% to 3.5 million metric tons. That represents a 1.6% decline compared to February 2014’s result, and brings Germany’s year-to-date production volume to 7.2 million metric tons, a decline of 0.6% compared to January-February 2014 production.

Italian steelmakers produced 2.0 million metric tons of raw steel during February, 4.7% more than during January 9.7% less than during February 2014. The year-to-date total for Italy is 3.8 million metric tons, 10.5% off the pace set by January-February 2014.

Beyond the EU, Turkish steelmakers produced 2.4 million metric tons during February, which is 7.3% less than during January and 12.2% less than during February 2012. The nation’s year-to-date production total is 4.97 million metric tons, down 11.3% compared to the same period of 2014.

In Russia, raw steel production totaled 5.7 million metric tons during February, down 7.6% from January but up by 5.6% over February 2014. The 2015 year-to-date volume for Russia is 11.9 million metric tons, 6.6% more than during the first two months of last year.

Ukraine steelmakers produced 1.6 million metric tons of raw steel during February, down 15.2% from January and down 33.2% compared to February 2014. The two-month total for 2015 is 3.46 million metric tons, a 29.2% decline compared to January-February 2014.

In Brazil, February raw steel production fell 9.6% from January to 2.7 million metric tons, though that total is up 2.3% over February 2014. Brazil’s year-to-date raw steel total for 2015 is 5.6 million metric tons, a 5.1% rise over the comparable 2014 result.

Finally, U.S. steelmakers produce 6.3 million metric tons of raw steel during February, a decrease of 13.8% from January and of 7.9% from February 2014. For the first two months of 2015, the U.S. steel industry has produced 13.5 million metric tons, 4.1% less than during January-February 2014.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.