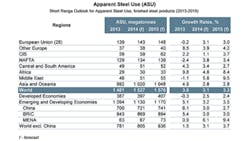

The World Steel Association is forecasting global steel consumption will continue to rise this year and into 2015, though the rate of increase will slow over the 2013 results. The trade group issued the results of its Short Term Outlook, and anticipates the current year will see 3.15% overall increase in steel consumption worldwide, or 1.527 billion metric tons, following a 3.6% increase for 2013.

The Outlook then foresees global steel consumption rising 3.3% in 2015, to a forecast total of 1.576 billion metric tons.

“On the other hand, many emerging economies continue to struggle with structural issues and financial market volatility,” Kerkhoff continued. “This, along with China’s deceleration, is the reason for our slightly lower global growth rate forecast for 2014.”

The Brussels-based World Steel Assn. represents 170 steelmakers in 65 nations, whose output comprises about 85% of global steel production. In addition to maintaining economic data and forecasts, the Association conducts programs to promote steel use, refine production technology, industrial safety and health, and sustainable development.

The Short Term Outlook includes targeted forecasts for various regional steel markets, including China specifically and the Asia in general; the U.S. and NAFTA; the European Union, and others.

He said 2015 would see growth accelerate thanks to recovery in developing countries, and improvements in emerging economies. “But China’s steel demand will further decelerate, according to Kerkhoff, “and this will prevent the broad recovery momentum from registering a higher global growth rate for 2015.”

Rebalancing in China, Rebounding in U.S., EU

China has been the world’s largest steelmaker and led the global steel expansion for more than a decade. Now, having expanded its steel output by 6.1% in 2013, with support from government infrastructure investment, China’s steel consumption is expected to slow 3.0% growth in 2014 (721.2 million metric tons.) The Chinese government is trying to “rebalance” the economy and continues to limit capital investment activities. In 2015, Chinese steel demand growth is expected to slow again, to 2.7%.

In the U.S., steel consumption decreased 0.6% in 2013, but the Association forecasts 2014-2015 will bring a return to growth. Apparent steel use will grow by 4.0% to 99.4 million metric tons this year, it predicts, and by 3.7% in 2015.

Steel consumption in the EU (28 nations) fell 0.2% in 2013, but now is expected to grow by 3.1% in 2014 to 143.3 million metric tons. This will be driven by demand in the construction sector, and while it noted “underlying trends at (the) national level will continue to differ,” the Association foresees increasing demand in Germany (+ 4.5% in 2014), Italy (2.6%), France (1.0%) and Spain (3.0%.)

It further forecasts that a broader and more durable recovery will result in steel demand growth of 3.0% in 2015.

“We continue to see challenges,” Hans Jürgen Kerkhoff said. “The recovery in Europe is still only mild and constrained by high debt and unemployment. Structural problems in the emerging economies are less likely to be resolved in the short term leaving them fragile and susceptible to external shocks. We are still seeing unexpected unstable political situations in many emerging economies. In this regard, the development involving Crimea raises a high downside risk for our outlook for the CIS region. Finally issues remain surrounding China’s debt and real estate bubble.

“In short, the global steel demand recovery continues but growth is stabilizing at a lower rate with continued volatility and uncertainty leading to a challenging environment for steel companies,” the economist stated.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.