U.S. Manufacturers’ Confidence at 20-Year High, NAM Finds

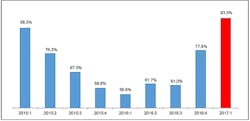

The National Assn. of Manufacturers reported that the results of its quarterly NAM Manufacturers’ Outlook survey show optimism increased to 93.3% during Q1 2017, a record high in the survey’s nearly 20-year history. The rise corresponds with an increase manufacturing activity, NAM noted, and is based on widely shared confidence that the administration of President Donald Trump will provide relief from government regulations, tax reform, and significant investments in U.S. infrastructure.

NAM is the largest manufacturing association in the United States, and represents more than 14,000 small, midsized, and large manufacturers in every industrial sector, in every state. For the past 20 years, NAM has surveyed its members each quarter to gain insight into their economic outlook, hiring, and investment decisions and business concerns.

In the latest survey, the 93.3% represents manufacturers who indicated they are “somewhat positive” or “very positive” about their own company’s outlook, up from 56.6% at Q1 2016 and 77.8% in Q4 2016. As a result, the NAM Manufacturers’ Outlook Index rose to 63.7% (also a new high) from 53.3% in December (Q4 2016), and marking the second straight quarter where the outlook exceeded its historic average (i.e., 50%.)

The details of the survey demonstrate the bases for manufacturers’ optimism. Respondents expect overall sales growth of 4.9% on average over the next 12 months, and on this point mid-sized manufacturers (50-499 employees) were even more optimistic, forecasting 5.2% growth in sales over the next year. 82.8% of all respondents expect sales to increase in the coming 12 months, and only 5.4% expect sales to decrease during that time.

As for production volumes, the consensus view is that output will increase by 4.8% in the coming year, up from 3.0% for the Q4 2016 survey.

Responding manufacturers also are gaining confidence about hiring and capital spending. The consensus view indicates a 2.3% rise in new full-time employment totals and a 2.1% increase in capital investment.

Both of those categories delivered negative results in the previous quarterly survey, NAM noted. Mid-sized manufacturers are the most likely to increase capital spending over the next year, anticipating 2.5% growth. Small manufacturers (less than 50 employees) are seen as the most likely to hire new full-time employees, up 2.6% estimated on average.

Manufacturers’ now predict a 1.0% increase in exports over the next 12 months, up from 0.6% in the Q4 2016 survey; 35.4% of all respondents expect exports to increase over the next year; 57.7% see no change in their firms’ exports.

Last, manufacturers expect their inventories to grow by 0.8% over the next 12 months, the first increase in inventories noted following seven straight quarterly declines. A little more than 30% of respondents forecast higher inventories, and about 50% predicting no change. NAM called this “a reassuring development, consistent with the pickup in activity seen in other measures.”

While manufacturers are decidedly confident in their current outlook, they also recognize there are significant political uncertainties to the current circumstance. The survey found particular concern about the Trump Administration’s trade policies, with 30.8% of all respondents indicating they are “unsure” whether the U.S. is “headed in the right direction.” NAM noted this measure has remained “highly volatile” in its past two surveys.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.