U.S. Machine Tool Orders Start Year With Sharp Decline

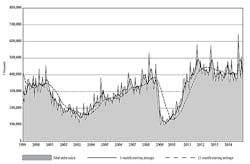

U.S. machine shops and other manufacturers ordered $341.17 million worth of new machine tools during January, a drop of 32.9% from December orders, and -4.8% off the total for January 2014. A drop in orders from December to January is not unusual, as manufacturers frequently seek to record capital purchases within an expiring tax year.

However, the sharp decline from the end of 2014 indicates a continuation of the listless demand indicated through most of last year, notably excepting September (concurrent with IMTS 2014) and December.

The totals are drawn from the latest release of the U.S. Manufacturing Technology Orders report, issued monthly by AMT – the Association for Manufacturing Technology, which records new orders for machine tools and related technology based on actual data reported by participating manufacturers and distributors. It covers both domestically sourced and imported metal-cutting equipment and metal-forming and -fabricating equipment.

By tracking new orders for capital equipment, the USMTO report functions as an index of confidence by manufacturing businesses, based on their business volumes and expansion plans.

The January results show new orders for 1,637 machines nationwide, including metal cutting machines and metal forming and fabricating machinery.

“To understand why we saw this drop in orders for January, December 2014 saw a sharp increase in sales. This was driven by many end-of-year orders that had been rushed through in order to qualify for tax rebate provisions that were enacted at the last minute for 2014,” offered AMT president Douglas K. Woods. “This is evidenced by the comparatively lower average order value seen in December versus January, meaning that most end-of-year orders were for less expensive, in-stock machines that could be shipped quickly.

“The decline wasn’t unexpected, and we still foresee the manufacturing economy keeping on a stable path,” Woods noted.

Each USMTO release also includes summaries of orders for metal-cutting and metal-forming and –fabricating equipment in six geographic regions of the United States. Despite the overall decline, half of the regions reported improved order volumes over the January 2014 totals. (Because AMT revised its geographic references in 2014, the association notes that some comparisons for Metal Forming and Fabricating equipment orders are not an accurate reflection of the current data. AMT also notes that the report’s data is adjusted to reflect this change, but some categories remain unreported.)

In the Northeastern U.S., January new orders for machine tools rose 2.2% from December, to $86.75 million. More encouraging, Northeastern regional orders for metal cutting equipment rose 26.9% versus the January 2014 order total.

The Southeast region reported a 57.4% decline in cutting-tool orders from December to January, and total manufacturing technology orders of $26.33 million. The year-to-year comparison indicated a 29.4% decline in overall manufacturing technology orders from January 2014.

The North Central-East region saw total manufacturing technology orders decline in January 43.2% from December, settling at $93.94 million. Even so, that total is 10.5% higher than the January 2014 total.

The North Central-West region reported new manufacturing technology orders fell 25.5% from December to January, to $57.10 million, but that total is 16.7% higher than the January 2014 result.

In the South Central region, January new orders for metal cutting machines declined 42.6% from December, to $27.29 million. The year-to-date comparison shows that figure to be down 40.4% from metal cutting machinery orders in January 2014.

Finally, in the West region, metal cutting machinery orders fell 33.8% from December to January, to $48.58 million, and total manufacturing technology orders were down 33.8% from January 2014.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.