U.S. Machine Tool Orders Up, but Growth is Not Sustainable

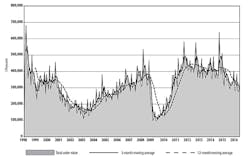

U.S. machine shops and similar manufacturers ordered $323.74 million worth of new machine tools and related manufacturing during June, a total that was 17.5% higher than the May summary, though it is 10.5% lower than the June 2015 order total.

These data is drawn from the monthly U.S. Manufacturing Technology Orders report issued by AMT – the Association for Manufacturing Technology. The USMTO report summarizes actual totals for machine tool orders reported by participating companies that produce and distribute metal-cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported machinery and equipment.

USMTO is used as a forward-looking indicator of manufacturing capital investment, similar to the Institute for Supply Management’s Purchasing Manager’s Index (PMI) — as companies place orders for new equipment to increase capacity and to improve current capabilities.

The June USMTO results bring the year-to-date order total to $1.83 billion, compared to $2.18 billion for the first the comparable January-June period of 2015. In other words, at the midpoint of 2016 machine-tool new orders are off last year’s pace by -15.8%.

AMT reported that, as of mid-year, current market forecasts indicate total new orders for 2016 will finish lower than 2015, which is a reversal of the forecast it made at the start of this year: in announcing its January USMTO results, AMT anticipated that manufacturing technology orders would finish 2016 up 3% compared to 2015 (or roughly $4.31 billion.)

“There are many mixed indicators in manufacturing right now, a reflection of its creeping growth rate overall,” commented AMT president Douglas K. Woods. “There has not been enough expansion activity to truly impact capital investment in new equipment.”

The group cited economic analysts characterizing U.S. manufacturing as “stabilized with the dollar moderating in value.” Machine tool inventories “are much lower,” according to the producers of such equipment, and the order mix reportedly is shifting to more complex and sophisticated products.

More than that, the Association noted that announcements for new and expanding manufacturing plants offer optimism for a rise in capital investment in the second half of 2017. It also expressed confidence that, as in the past, new machine tool orders will follow IMTS 2016, taking place September 12-17.

“This historical average pickup in orders for the months that immediately follow IMTS is 32%, which we expect to see again this year,” Woods offered. “But beyond that our industry is not likely to see sustained growth in order activity until the broader manufacturing economy accelerates.”

In addition to the nationwide order summary, the USMTO offers totals for regional order activity. In the Northeast, June orders for new manufacturing technology orders rose 58.5% from May to $83.476 million; that figure is 10.5% less than the June 2015 result, and the year-to-date total value for new orders in the Northeast is $376.9 million, down 12.9% from the January-June 2015 total.

In the Southeast, new orders for metal cutting equipment totaled $35.7 million, up 7.7% from May and down 1.1% from June 2015. For the year-to-date, the region’s total manufacturing technology new orders stand at $226.3 million, up 13.2% compared to last year’s first half.

For the North Central-East region, total manufacturing technology orders rose 36.7% from May to June, with the latest month falling 1.7% behind last June’s total. For the year-to-date, regional new orders stand at $466.0 million, down 22.0%.

The North Central-West region reported new orders for metal-cutting equipment at $52.14 million for June, down 16.0% from May and down 19.1% from June 2015. For January-June, the regional new-order total is $340.28 million, or 19.3% less than the comparable total for last year.

The South Central region reported June new orders for metal-cutting equipment of $18.42 million, 15.4% higher than the May result but 45.3% less than the June 2015 total. Total manufacturing technology orders in the region, year-to-date, were $118.2 million, down 36.0% from last year.

West regional new orders for metal-cutting equipment fell 7.6% from May to June, to $42.95 million, and that figure is 25.5% less than the June 2015 result. The region’s six-month total for 2015 manufacturing technology orders is $306.27 million, which is down 10.3% from the January-June 2015 total.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.