U.S. Machine Tool Orders Dropped 11.8% in July

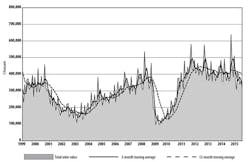

New orders for machine tools fell 11.8% from June to July, totaling $318.33 million for the month, and dropped 11.1% versus the year-ago result for July 2014. It was the second-lowest monthly total in the past 12 months, and the second-lowest total for units ordered, and while the pace is well off the peak set for new orders in September 2014 there is no clear trend as the index wavers from month to month.

The 2015 year-to-date orders are valued at $2.48 billion, down 8.7% from the seven-month total for 2014.

The totals are contained in the U.S. Machine Tool Orders Report, which is issued monthly by AMT – the Association for Manufacturing Technology from participating companies who produce and distribute metal-cutting and metal-forming and –fabricating equipment, and including domestically manufactured and imported equipment. The report is based on actual values for new orders, and the results are presented as nationwide totals and as totals for six regions of the U.S.

AMT presents the report USMTO as “a reliable leading economic indicator, as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity.” Current manufacturing activity is more clearly indicated by the monthly Cutting Tools Market Report, co-presented by AMT and the U.S. Cutting Tool Institute, though over the past year that index also indicated weak domestic manufacturing activity.

“The mood among manufacturers right now is best described as ‘caution cubed’,” observed AMT president Douglas K. Woods, “… concerns around disruption in China, a drop in some key economic indicators like PMI and housing starts, and softening in large customer industries, including agriculture and energy.

“Additionally, consumer confidence dropped in July, and the situation in Europe first with the Greek bailout and now the large influx of refugees is creating added uncertainty,” Woods continued. “Given all of that, it’s no surprise that manufacturers are wary about making large investments in capital equipment.”

The USMTO also presents regional results for new orders of both metal-cutting and metal-forming and -fabricating equipment. In the Northeast region, new orders fell 14.7% overall for the month, $65.49 million -- though new orders for metal-cutting equipment are up 27.4% compared to July 2014, and are up 15.4% YTD through the first seven months of 2015.

In the Southeast, July’s new machine tool orders increased 1.9% to $38.2 million, though at $239 million the January-July total is down 1.7% from the comparable figure for last year.

In the North Central-East region, new orders increased, but barely: the total of $85.9 million is 0.3% higher than June’s result, and compared to last July the total is down 7.5%. Year-to-date orders are down 9.9% compared to the first seven months of 2014.

In the North Central-West Region, new orders fell 14.1% from June, to $58.3 million. The seven-month total for metal-cutting equipment new orders is $463.57 million, up 7.8%versus the comparable figure for last year.

In the South Central region, metal-cutting equipment new orders fell 37.8% from June, to $21.91 million for July. The region’s YTD total is now $211.53 million, which is down 51.6% compared to the analogous period for 2014.

Lastly, the West region reported new orders for metal-cutting equipment totaling $43.92 during July, down 23.0% from the previous month and down 18.5% from July 2015. Total new orders are down 20% compared to July 2015, and year-to-date orders, now at $379.77 million, are down 6.6% compared to the first seven months of 2014.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.