U.S. Machine Tool Orders Drop Again, Outlook Dims

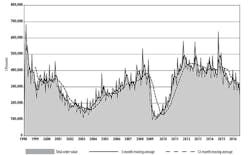

U.S. manufacturers and machine shops ordered $246.38 million worth of metal-cutting and metal-forming and –fabricating equipment (collectively, "manufacturing technology") during July, down 24.8% from the June figure. It is the fourth month of declining value in new orders this year, according to the monthly U.S. Manufacturing Technology Orders report, compiled by the AMT – the Association for Manufacturing Technology.

The USMTO report summarizes actual totals for machine tool orders reported by participating companies that produce and distribute metal-cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported machinery and equipment.

Through the end of July, U.S. manufacturing technology new orders total $2.09 billion, 16.3% lower than the January-July 2015 order total.

“The automotive and aerospace industries moved into a summer slump, piling on to manufacturing’s ongoing challenges from the effects of a strong dollar, weakness in key export markets and a soft oil and gas industry,” stated AMT president Douglas K. Woods. “Manufacturers are feeling cautious about the economy and hesitant to make new investments until they get a better sense of certainty.”

The July USMTO report was issued just before the opening of IMTS 2016, the biannual trade show for manufacturing technology that consistently represents the North American market’s biggest commercial opportunity – and the industry has nurtured hopes that IMTS-timed new orders would reverse that trend.

However, with the release of its June USMTO report, AMT set aside its previous forecast for machine tool demand: since January it had anticipated a Q4 2016 upswing in manufacturing demand. Then, in August, AMT reported that current market forecasts indicate total new orders for 2016 will finish lower than 2015.

Now, AMT reports manufacturing technology demand “will not return to positive growth not coming until the second quarter of 2017.” While still expressing confidence that IMTS will deliver an increase to new orders, the group now holds the position that “sustained growth in orders is unlikely in the immediate future.”

The USMTO report also includes summaries of order activity at the regional level, though only one of the six regions reported growth in order values during July.

In the Northeast region, July new orders for all manufacturing technology types totaled $47.66 million, which is 42.7% lower than the June total and 28.2% lower than the July 2015 total. Through the first seven months of 2016, the Northeast has logged $423.75 million worth of new orders – which is 15.1% lower than last year’s comparable total.

In the Southeast, new orders for metal cutting equipment rose 15% from June to July, finishing the month with $40.98 million worth of bookings. That figure is up 13.8% from last July’s total, and the region’s January-July total for all manufacturing technology orders is $267.92 million, or 12.1% higher than last year’s seven-month total.

The North Central-East region reported July new orders worth $48.47 million for all manufacturing technology, down 42.9% from the June result and down 43.9% from last July’s result. The regional year-to-date total for manufacturing technology orders is $515.46 million, a 24.6% decline from the January-July 2015 report.

The North Central-West region drew new orders for metal-cutting equipment worth $47.05 million during July, down 10.1% from the June figure and down 16.3% from the July 2015 figure. The region’s 2016 total for manufacturing technology new orders is $397.19 million, through July, a 17.0% decline versus last year’s comparable figure.

In the South Central region, July new orders for metal-cutting equipment totaled $13.61 million, a decline of 26.1% from the June figure and a drop of 36.9% from the July 2015 figure. The region’s year-to-date total for all manufacturing-technology orders is $132.94 million, a 36.9% decrease from the January-July 2015 total.

Finally, in the West region, new orders for metal-cutting equipment fell 16.3% from June to July, to $38.82 million. That represents a 13.5% decline from the July 2015 total, and contributes to a January-July total for all manufacturing technology orders in the West region of $353.62 million, a decline of 8.6% year-over-year.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.