November Report Shows Another Drop in Machine Tool Orders

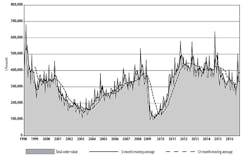

New orders for machine tools declined in November for the second consecutive month, following the increases in August and September, coinciding with IMTS 2016. U.S. manufacturers ordered $329.61 million worth of new manufacturing technology during November, according to the U.S. Manufacturing Technology Orders (USMTO) report issued each month by AMT – the Association for Manufacturing Technology.

USMTO report summarizes actual totals for machine tool sales, nationwide and in six regions, as reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment. AMT describes USMTO data as a reliable leading indicator of the industrial economy, as manufacturing companies invest in capital equipment to increase capacity and improve productivity.

The November USMTO results indicate a 2.4% decline from October and a 1.3% decline from the November 2015 results. Through 11 months of data, 2016 new orders total $3.578 billion, which is 5.1% lower than the January-November 2015 order total.

AMT commented that motor vehicle, aerospace, and job-shop manufacturing “showed increased order activity” in the last months of 2016, which it related to “capital investment in anticipation of a need for additional capacity.”

It also opined that some leading economic indicators suggest stronger activity to come, namely the Institute for Supply Management’s monthly Purchasing Managers Index (PMI), which rose in December for the fourth consecutive month; and that new orders and production for U.S. factories rose to their highest levels since 2014.

“While our industry endured some challenges in 2016, bookings for the last few months of the year were better than expected and early input on January is very promising, particularly in the aerospace and job-shop sectors,” stated AMT President Douglas K. Woods.

The November results showed considerable disparity in different geographic regions. In the Northeast, new orders for manufacturing technology totaled $63.18 million for the month, 16.0% higher than in October but 16.1% lower than November 2015. The region’s 11-month total rose to $688.09 million, which is 5.1% lower than the comparable total for 2015.

The Southeast region’s November total for metal-cutting equipment orders fell 31.0% from October, and 2.1% from November 2015. For the first 11 months of 2016, the region’s manufacturing technology new orders totaled $496.83 million, which is 24.3% higher than previous year’s January-November total.

The North Central-East region had total manufacturing technology orders of $71.97 million during November, 31.6% lower than during October and 27.3% lower than during November 2015. The region’s year-to-date total through November was $896.80 million, 16.9% lower than the comparable figure for the region during 2015.

The North Central-West had November metal-cutting equipment new orders of $85.78 million, which is 42.0% higher than the October result and 67.6% higher than the November 2015 result. Total year-to-date manufacturing technology orders for the region were $682.66 million through November, 1.4% lower than the comparable figure for 2015.

The Southwest region reported new orders for metal-cutting equipment totaling $18.08 million, 13.4% higher than the October result but 41.1% lower than the November 2015 result. The region’s 2016 year-to-date manufacturing technology orders stood at $207.39 million through the end of November, which is 28.2% lower than the January-November 2015 total.

Last, in the West region, November’s metal-cutting equipment orders rose 4.9% from October and 28.9% from November 2015, to $56.37 million. The West’s year-to-date manufacturing technology orders through November were up 3.5% year over year, at $605.95 million.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.