New Orders for Machine Tools Fell 8.1% in April

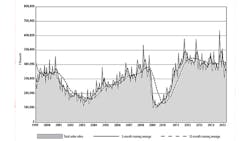

U.S. manufacturers ordered $384.81 million worth of new metal cutting and metal forming equipment during April, a drop of 8.1% from the March total, and 1.0% from the April 2014 result. The results are contained in the U.S. Manufacturing Technology Orders report, issued monthly by AMT – the Association for Manufacturing Technology.

With cumulative orders totaling $1.46 billion for the current year, the result is 8.5% less than the result for the same four-month period of 2014.

The USMTO reports track production and distribution of “manufacturing technology” nationwide and on a regional level, for both domestic and imported machine tools and related equipment. The totals are supplied to AMT by participating companies, and cover actual totals for orders of metal-cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported equipment.

AMT notes that investments in machine tools are an indicator of manufacturing confidence because of their role in the production of engineered components. AMT – the Association for Manufacturing Technology compiles the United States Manufacturing Technology Orders (USMTO) report to track production and distribution of “manufacturing technology” nationwide and on a regional level, for both domestic and imported machine tools and related equipment. AMT also collaborates with the U.S. Cutting Tool Institute to issue to the monthly Cutting Tool Market Report, which tracks ongoing activity.

Although the manufacturing technology orders figures for any single month are inconclusive as to overall trends, the April figures represent the third monthly decline in four months of the current year, and the fourth monthly decline in the past six months.

“Right now capital equipment makers are feeling the effects of a stronger dollar, which creates a drag on exports, and lower oil and natural gas prices, which means less spending on equipment investments from the energy industry,” observed AMT president Douglas K. Woods.

“But, what is a negative now should help us later,” Woods continued. “Imported components for capital equipment are costing less, and businesses will accumulate savings from lower fuel prices in the coming months, meaning more money for capital investment. We believe investment in manufacturing will remain steady, and overall performance for the year will be as strong as we saw in 2013 and 2014.”

In addition to the total for all U.S. orders, the USMTO report includes results for regional demand in six geographic sectors. New machine-tool orders in the Northeast dropped 11.5% from March to April, settling at $65.95 million, manufacturing technology orders in April stood at $65.95 million, 11.5% less than the $74.55 million total for March but 6.9% more than the $61.71 million for April 2014. For the first four months of 2015, the Northeast region has posted $283.55 million in sales of metal-cutting equipment, 12.1% more than during the comparable period of 2014.

In the Southeast, April’s total new orders for metal-cutting tools fell 7.2% from the previous month to $32.15 million. That represents a 26.0% drop from the April 2014 figure. The Southeast has had total new orders of $127.35 million for the January-April period, 14.3% less than during the first four months of last year.

The North Central East reported total new orders of $127.57 million for April, a 4.1% increase from March and a 29.9% increase from March 2014. The region’s cumulative total for 2015 new orders is $417.42 million, a decline of 10.5% compared to the same four-month period of 2014.

The North Central-West had new orders for machine tools totaling $68.43 million, a decline of 19.5% from March but a rise of 6.9% from the April 2014. The year-to-year comparison shows a 20.6% improvement from April 2014.

In the South Central region, new orders for metal-cutting equipment rose 25.6% from March, to $38.31 million. That figure is 37.3% less than the April 2014 result, and the 2015 year-to-date total for all machine tool orders in the region is $124.44 million, or 47.9% less than the result for the same period of 2014.

Finally, in the West, new orders for metal-cutting equipment fell 27.7% from March to $48.97 million, a result that also falls 11.7% behind the April 2014 figure. For the January-April period, the West region has metal-cutting equipment orders totaling $203.86 million, or 13.3% less than during the comparable period of 2014.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.