Machine Tool Orders Fell in May for Third Straight Month

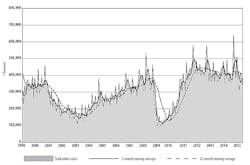

U.S. manufacturers’ orders for new machine tools and related technologies declined during May for the third-consecutive month, and the fourth month out of five in 2015. The weak demand, which has been recurring for nearly a year but with intermittent bursts of heavy demand (e.g., during September and December 2014) suggest weakening confidence in business conditions by machine shops and similar operations.

According to the latest United States Manufacturing Technology Orders (USMTO) report, new orders totaled $336.98 million for the month, 13.2% less than during April and 6.2% less than during May 2014.

The USMTO reports track production and distribution of “manufacturing technology” nationwide and on a regional level, for both domestic and imported machine tools and related equipment. The totals are supplied to AMT – the Association for Manufacturing Technology.by participating companies, reflecting actual totals for orders of metal-cutting and metal-forming and –fabricating equipment, and including domestically manufactured and imported equipment.

“In large part, the decline in manufacturing technology orders is due to smaller manufacturers feeling a sense of economic uncertainty and therefore hesitant to make any kind of capital investment,” stated AMT president Douglas K. Woods.

A similar slowdown is seen in the monthly Cutting Tool Market Report, issued by AMT and the U.S. Cutting Tool Institute, though that report is a measure of industrial activity, not manufacturers’ confidence.

Woods continued: “In addition, the energy industry has curbed its spending, accounting for about half of the year-to-date decline in orders, and aerospace did not perform as well as expected in the first quarter. We expect the downturn to ease thanks to strong performance in the automotive and medical industries, with industrial production and a stronger PMI also indicating resilience in manufacturing.”

While the nationwide figures suggest an overall malaise, there is some indication of progress in certain regions. In the Northeast, total new orders (metal cutting equipment, metal forming and fabricating equipment) declined 4.2% from April to $62.20 million.

Southeast regional demand for metal-cutting equipment declined 2.5% from the April result, to $32.45 million.

In the North Central-East region, total machine tool orders declined 35.4% from April to $85.32 million. That figure is 6.1% less than the May 2014 total and brings the region’s five-month total for 2015 new orders to $507.12 million, 7.3% less than during the same period of last year.

In the North Central-West region, new orders for all machines fell 8.2% from April to $63.47 million, a figure that is 13.0% higher than the May 2014 result, the region’s January-May 2015 total is reported to be 17.5% higher than for the comparable period of 2014.

In the South Central region, new orders for metal cutting machines fell 37.5% to $23.84 million, and at $147.84 million the five-month total for all new orders in the region is down $52.9% year-over-year.

Finally, in the West region, new orders for metal cutting machines increased 38.2% from April to May, to $66.4 million. Even so, the region’s January-May orders for metal cutting machines are down 7.5% versus the comparable period of 2014.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.