Machine Tool Orders Declined Again in January

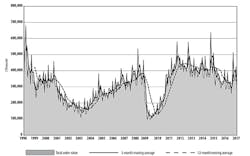

Domestic manufacturers’ new orders of machine tools and related technologies fell 40.7% from December 2016 to January 2017, from $425.18 million down to $252.21 million, and chilling for now some of the optimism that has been building in the U.S. manufacturing sector. The year-on-year comparison shows the January results fell 11.4% from January 2016’s total.

New orders for cutting tools have been flat or declining for much of the past two years, with some incidental peaks sparking hopes for a steady revival of manufacturing demand, such as the high volume recorded during September 2016, coinciding with IMTS 2016, or the year-end increase that was registered during December 2016.

“January’s slump was not unexpected as it was in line with analyst forecasts for a soft start to 2017. We continue to be on track for an upturn later in the spring,” according to Douglas K. Woods, president of AMT – the Association for Manufacturing Technology.

AMT releases the total value for new orders of machine tools in its monthly U.S. Manufacturing Technology Orders Report. USMTO summarizes actual totals for machine tool sales, nationwide and in six regions, as reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment.

AMT describes USMTO data as a reliable leading indicator of current activity in the industrial economy, as manufacturing companies invest in capital equipment to increase capacity and improve productivity.

Notwithstanding the drop in new orders, Woods offered a series of examples that suggest higher levels of investment are imminent: “Several large capital expansion projects have been announced in recent weeks,” the AMT president noted, “and the PMI was up for the sixth consecutive month. Our members report increased quotation activity and at the Houstex show in early March; both attendees and visitors were upbeat.”

He pointed to several high-profile expansion projects ($386 million at Pratt & Whitney, Columbus, O., $600 million at Toyota, Princeton, Ind.) and to the increased activity indicated by the latest Cutting Tool Market Report, as evidence of “a coming upturn in orders for capital manufacturing equipment.”

Even so, the decline in January orders was evident across the six regions included in the USMTO. In the Northeast, new orders for metal-cutting equipment fell 43.9% from the December result to $46.95 million during January. That figure is 16.8% lower than the January 2016 regional result.

In the Southeast, new orders for metal-cutting equipment totaled $27.06 million, down 36.5% from December and down 30.2% from January 2016.

The North Central-East region reported new orders totaling $63.74 million for January, 34.9% less than the December total and 3.0% less than the January 2016 result.

In the North Central-West, January new orders for metal-cutting equipment fell 41.5% from December, and dropped 7.0% from January 2016.

January new orders for metal-cutting equipment in the South Central region were down 36.5% from December, but were up 53.5% from January 2016.

Finally, the West region had January new orders for metal-cutting equipment totaling $48.63 million, 44.5% less than December’s total and 6.9% less than the January 2016 total.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.