Italian manufacturers are gathering profits, despite a decline in the global machine tool industry.

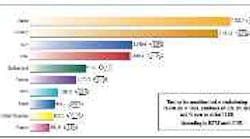

Main outlet markets of Italian machine tool exports in 1999. (% share on total export) *According to ISTAT and UCIMU

If the global machine tool industry gave out awards in Olympic fashion, Italy would earn the bronze with its newly acquired third-place ranking in world output, export, and consumption.

According to ISTAT, Italy's government statistics office, Gross Domestic Product in that country increased by 1.4% in 1999, which was a 0.1% decrease in growth from 1998. But in the end of 1999, the GDP grew 0.4% in one quarter, which Italians interpreted as a good indicator of "less weak growth in 2000."

The machine tool economy in Italy, however, is accomplishing much more than just "less weak growth." ISTAT reports that despite the global machine tool industry's decline in 1999, with sales down 7.5%, exports down 4.8%, and imports down 6.1%, the Italian machine tool industry has reason to celebrate. Production output rose 2.9%, reaching $3,750 million, to make Italy the world's third-largest producer with a global output of 11.1%. Italy also held a third place ranking as an exporter with sales abroad totaling $2,020 million and a global share of 9.8% behind Japan and Germany. Countries buying Italian machine tools were Germany with a 15.4% share of Italian exports, France (14.2%), the U.S. (9.9%), Spain (9.3%), Brazil (6.4%), the U.K. (4.2%), and China (3%).

Even though ISTAT showed a 21.9% decline in output that bumped it to fourth place behind Italy, the U.S. was still the biggest market for machine tool consumption. Italy edged out Japan to also rank third in the consumption category behind the U.S. and Germany. Together those top three countries accounted for 48.6% of the total world market.

Italy also did well in all of its various machine tool segments. For metal forming, the country increased production 5.7% and held a 16.5% share to rank second in global output behind Germany. In the robotics industry, there was an increase of 15.4%.

Internal demand for machine tools in Italy rose in 1999 by 10.2%, but foreign manufacturers did not profit from this demand. Imports into Italy actually decreased that year 2.3% — more good news for Italian manufacturers. German, Japanese, and Swiss producers dominate what import market there is in Italy, but the U.S. increased its sales to Italy to leap-frog over Belgium into the fourth position.

ISTAT predicts continued growth in the year 2000 with output expanding at 6.9% and exports expecting to rise 3%. In fact, orders obtained abroad between January and March 2000 were up 23.8%.

UCIMU-Sistemi Per Produrre, The Italian Machine Tools, Robots, and Automation Manufacturers' Association, reports that the biggest marketplace challenges for Italian manufacturers are increasing globalization and reducing time to market. Because of the small to medium size of most Italian manufacturers (often run directly by the owner with less than 70 employees), UCIMU believes Italian companies have to internally re-structure and ban together to form alliances. Restructuring for globalization would involve setting up clear trading channels, providing assistance, and producing machines in a variety of different locations. Alliances would help small companies accomplish reorganization goals and also speed innovation - uniting small firms' R&D efforts to stay ahead of demand.

In order to tackle JIT delivery, UCIMU calls for further internal restructuring and analysis of production methods. "Each firm needs to optimize the way it functions as an overall unit by reviewing and, where necessary, re-designing to achieve broad integration of all company procedures - from product origination, through engineering and production, policy making on sales and marketing, and right up to aftersales service."

Synonomous with JIT manufacturing is flexi-bile manufacturing, and the Italian manufacturers have already mastered this business model. Smaller company size has enabled the country to rapidly respond to the market, manufacture limited volumes when required, and keep costs down for clients.

Because of Italian propensity towards flexibility, customized solutions have been the country's specialty for some time. So it is no surprise that highly customized, transfer machinery production accounted for the largest share of Italian output in 1999, according to the latest UCIMU statistics. Transfer machine production was followed in volume by presses, lathes, milling-boring machines, and machining centers.

The UCIMU also reports that Italy is responding to the demand for flexible, modular, and re-configurable production systems, especially for the automotive industry. In addition to specialization and flexibility, the country's manufacturers are tackling the customer's need for highly-capable machinery.

According to UCIMU, "One of the main objectives of the Italian machine tool industry is to increase the operational capability of their machines as much as possible. High capacity levels are built-in during the design phase and are guaranteed by the provisions of suitable tools such as remote diagnostics, remote servicing, and other methods to reduce machine downtime."

The agency also reports that Italian companies are paying careful attention to the environ-mental aspects of manufacturing.

For example, various measures are being immediately adopted to reduce the use of lubricants or use vegetable lubricant additives. And long-term goals include the use of dry-machining technology.

UCIMU provides its members, who account for approximately 70% of the Italian manufacturing firms in the machine tool, automation, and robotics sectors, with specialist support covering all areas of company activity. The association also serves as an alliance organization, calling on the services of c o m p a n i e s belonging to the association.

As one of the official representatives of Italian industry, the association is an ambassador throughout the world for the advanced technology made in Italy. Among the events promoted by UCIMU is BI-MU, a biennial exhibition showcasing worldwide production of machine tools, robots, and automation. The October 2000 BIMU held at the Milan Trade Fair District was a success. On display were the products and services of 2,211 manufacturers represented by 1,530 direct exhibitors and 361 agents and representatives. There were 1,078 manufacturers from 38 countries outside Italy.

There were 127,200 visitors, an increase of 3.6% on 1998 attendance figures. Of these, 102,815 were Italian while 11,648 were from 89 other countries worldwide.